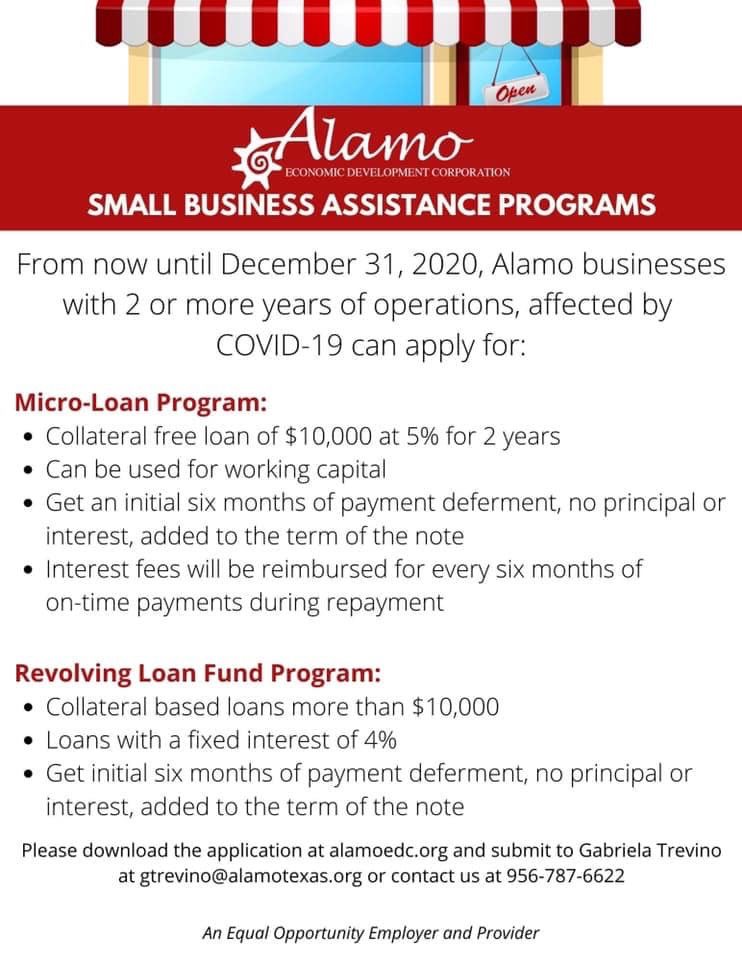

Local business owners in Alamo have had to adjust to the pandemic by modifying hours, reducing their workforce, and, sadly, even shutting their doors for extended periods. At the Alamo EDC, we’ve seen the toll that the pandemic has taken on these businesses. Our programs can help by offering working capital at fixed loan interest rates. Keep in mind that the deadline to sign up for our programs is approaching. Learn more about them below!

The Micro-Loan Program

This program offers collateral-free loans that were adjusted earlier this year to provide even more help. They can:

- Be used to pay for repairs and/or renovations to commercial property

- Improve signage

- Be used for purchasing new equipment

- Be used as working capital

Adjusted for 2020

Changes were made in April to encourage business owners to utilize our micro-loans. These include:

- An increase from $5,000 to $10,000 with a 5% interest rate for two years.

- Business owners qualifying for six months of no payments on principal or interest of the notes.

- Interest rate reimbursement to the noteholders every six months if payments are made on time.

Capital for a New Business

Starting a new business in any climate can be tough, but with the Revolving Loan Program, it can be easier with a low-cost financing option. Changes made earlier this year to administer additional help include:

- Presenting up to $150,000 in collateral-based loans on 10-year notes.

- Setting interest rates at 4%.

- Making the initial six months as payment deferment with no principal or interest added to the loan.

Let’s Get to Work!

This year has been tough on everyone, but the Alamo EDC is here to help. Contact us today for more information.