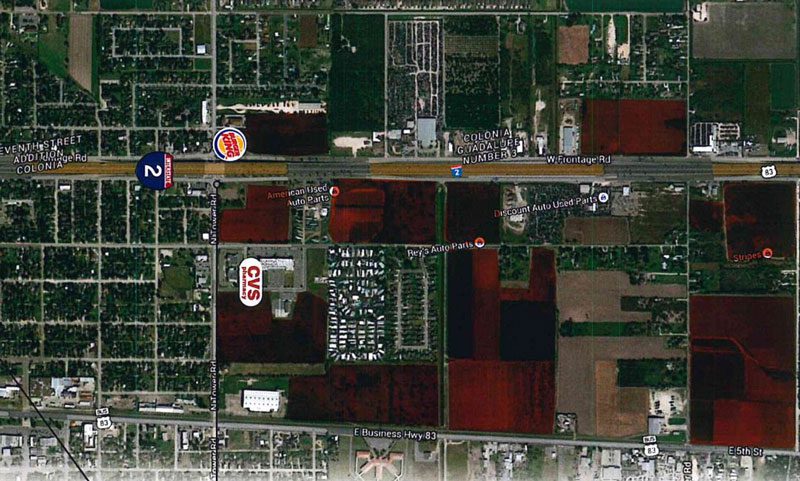

TIRZ properties are highlighted in red.

TIRZ properties are highlighted in red.The City of Alamo is gaining traction with new businesses opening on a regular basis. Being conveniently located near bigger cities like McAllen and Edinburg means that our city is the ideal choice when deciding where to locate new and established businesses. Local businesses can collaborate with the Alamo Economic Development Corporation (EDC) to foster an empowering and successful economic environment.

In collaboration with the city, the Alamo EDC and City Council have even more business opportunities by outlining about 400 acres specifically to the Alamo Tax Increment Reinvestment Zone (TIRZ)

What is TIRZ?

TIRZ is a tool that allows governments to designate a portion of tax increments to finance improvements to promote development of a defined area. When a TIRZ in Alamo is created, the city records the sum of the ad valorem property tax at the time of creation for the properties within that zone. It’s similar to taking a snapshot in time of what the property taxes are at that specific moment. The city records that number as the “base tax value.”

Each year within the TIRZ, the property taxes collected up to that “base tax value” number continue to go into the city’s general fund, as most taxes do. But as properties in the TIRZ develop and become more valuable, any additional property taxes collected, over and above that “base tax value” number, go directly into a TIRZ fund. Those property taxes can only be used within the TIRZ for infrastructure, facade programs, landscaping, street-scaping or other public enhancements, allowing your business to prosper and generate appeal.

In developing the TIRZ incentive, the city has designated up to $5 million for potential economic development incentives. Alamo established the zone in 2009 and is set until 2032.

The Necessary Steps

Areas that don’t attract a substantial amount of market development in a timely manner can benefit from TIRZ, which helps finance the cost of redevelopment while encouraging future development in designated areas. The boundaries of the zone can subsequently be improved thanks to a fund set aside and made up of tax increments. In order for a TIRZ to be created, several steps must be taken:

- Property owners possessing over 50% of the appraised value of a district can request a petition for a TIRZ. The decision to create a TIRZ could also be made by the local government, but only if less than 10% of the land is residential.

- A lifetime for the TIRZ is decided.

- The assessed values of properties within the TIRZ boundaries are frozen for tax-collecting bodies, such as water districts or counties. Property values within the TIRZ are expected to increase during its lifetime.

- Taxes made from the property’s value will then make up the “increment”, which will be donated to the improvement fund. Local taxing authorities, independent from the TIRZ-creating organization, will be in charge of determining how much of the increment will be donated.

- A governing body for the TIRZ, along with the formation of the zone as a legal entity, will be established by an ordinance passed by the municipality or county. The governing body will create a budget for the TIRZ, which determines which projects will be made along with how they will be financed.

Why Alamo?

There are over 100,000 people with a retail demand potential of over $500 million within a 10-minute radius of Alamo. A young, bilingual and skilled workforce has made Alamo a part of the fastest growing Micropolitan Statistical Areas in Texas, giving businesses the advantage of investing in an emerging city.

Alamo serves as an international gateway to cities like Nuevo Progreso and Tamaulipas, and international trading and commerce only increases when Winter Texans arrive. With an average 119,480 daily traffic count in Alamo on Interstate 2/ U.S. 83, our city is full of opportunities for businesses looking for the perfect location with growing potential.

Let’s Succeed Together

The Alamo EDC is here to help improve your business outlook and encourage the local commercial environment. Through collaboration and innovation, the city and the Alamo EDC are able to offer you the TIRZ incentive. Our economic development efforts are aimed at facilitating higher levels of prosperity for businesses of all scopes and sizes in Alamo. For more information about the Alamo EDC’s business empowerment initiatives, reach out to us at 956.787.6622.